Describe How the Money Supply Grows

Define the monetary base and explain its importance. Inflation is caused when the money supply in an economy grows at faster rate than the economys ability to produce goods and services.

Increasing Money Supply Economics Help

Obviously it does this less often as overall the money supply is growing.

/supply_curve_final-465c4c4a89504d0faeaa85485b237109.png)

. An increase in the money supply MS causes an increase in the real money supply MS P since P remains constant. We can define the money supply in three different ways - M1 M2 and M3. Most of the time this is a purely electronic transaction.

Answer 1 of 12. Money supply and inflation. If the money supply.

The reverse happens when the central bank tightens the money supply by selling securities on the open market drawing liquid funds out. The nominal interest rate is the rate of interest before adjusting for inflation. Monetarists believe there is a strong link between the money supply and inflation.

In the diagram this is shown as a rightward shift from MS P to MS P. Updated on January 15 2019. These explanations are also accompanied by relevant graphs that will help illustrate these economic transactions.

Everyone on the island gets 10 per day Lets say we have a burger shop and this burger shop makes 10. Money supply can rise if Government sells bonds or bills to the non-banking sector. Due to changes in the financial system the money supply has been difficult to measure accurately this makes it difficult to implement Monetarism which states there is a relationship between the money supply and inflation.

Because the money supply grew and the output of goods and services did not. Everything else being equal an increase in the money supply is likely to cause inflation. Increasing the money supply eg.

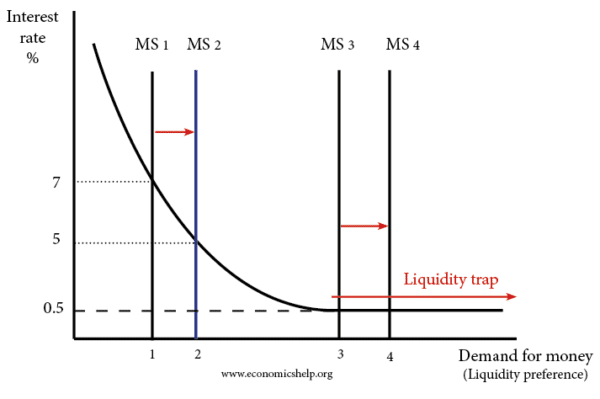

At the original interest rate real money supply has risen to level 2 along the horizontal axis while real money demand remains at level 1. This is how money supply and money demand come together to determine nominal interest rates in an economy. If the public buys anything from the government they will reduce their deposits in banks.

Describe who determines the money supply. Since growth is very often conceived as being demand led more demands of goods or whatever at a constant level of supply of those goods or whatever in turn means inflation until levels of supply here and there adjust and create jobs generate dividends etc. There will be no expansion in the money supply.

Through quantitative easing creating money electronically In many circumstances an increase in the money supply could lead to a depreciation in the exchange rate. The money supply can be increased in an economy by purchasing government securities such as treasury bills and government bonds. Describe the multiple deposit creation.

The Fed can influence the money supply by modifying reserve requirements which generally refers to the amount of funds banks must hold against deposits in bank accounts. Define open market operations and explain how they affect the monetary base. Explain how the central banks balance sheet differs from the balance sheets of commercial banks and other depository institutions.

This is for two main reasons. In our auction economy the production of goods and services was unchanged but the money supply grew from round one to round two. Lets make it simple First of all let me tell you that Humans wants our unlimited So lets start with a hypothetical scenario.

Each bank must have reserves equal to 10 of its checkable deposits. This means banks will be willing to lend a larger proportion of their funds. The money supply is commonly defined to be a group of safe assets that households and businesses can use to make payments or to hold as short-term investments.

Increasing the money supply is like lighting a fire under the economy to increase economic output How the Fed Achieves its Objectives In order to achieve its three objectives of maximum employment. Because reserves equal required reserves excess reserves equal zero. M1 is the narrowest definition of money.

To conclude and summarize Basic Reason of Why the Money Supply Needs to Increase. Dollar but increases the. You live on an island whose population is 100.

The Federal Reserve increases the money supply by buying government-backed securities which effectively puts more money into banking institutions. M1 consists of coins and currency in circulation checking accounts and travelers. Use graphs to explain how changes in money demand or money supply are related to changes in the bond market in interest rates in aggregate demand and in real GDP and the price level.

The money supply is the total amount of moneycash coins and balances in bank accountsin circulation. An inflow of funds from abroad. Each bank is loaned up.

In this section we will explore the link between money markets bond markets and interest rates. Banks choose to hold a lower liquidity ratio. An increase in paper money reduces the value of the US.

Picture the central bank giving up some money to acquire the bond thereby putting FRN or reserves into circulation. If it sells it takes money out of circulation. 38 Related Question Answers Found What happens if money supply decreases.

We first look at the demand for money. More often it buys. The required reserve ratio is 01.

Money supply can rise if Central Banks print more money. Currency and balances held in checking accounts and savings. If the B of E has to buy the surplus pounds on the foreign exchange to build up foreign reserves.

This transfers money from its account to someone elses account. By purchasing bonds or anything else for that matter the central bank increases the monetary base and hence by some multiple the money supply. The balance sheet for one of these banks Acme Bank is shown in Table 242 A Balance Sheet for Acme Bank.

By lowering the reserve.

/Supplyrelationship-c0f71135bc884f4b8e5d063eed128b52.png)

Comments

Post a Comment